Focus on what’s working and then move towards expanding the reach. Sounds pretty simple, right? Well, you should ask these questions to those companies that learned it the hard way.

Paypal, now a household name, didn’t have the best start. The billion-dollar company started out as “Confinity” which provided customers with a platform to do money exchange via PalmPilots (a former smartphone brand). The company faced a crisis when it realized that very few of its target customers actually owned PalmPilots, leading them to inevitable failure. But that changed when the company partnered with eBay and made PayPal the payment channel of choice for its eCommerce customers. That pivot actually helped in making the company a common name for secure online payments.

How does the Product Market Fit survey fit into this? For starters, the end customer can fluctuate. A brand needs to analyze, evolve, and adjust as it identifies the new target segment and what problems you’ll be solving for them. And what better way to know all this than by taking product feedback from the customers themselves?

No matter how instrumental a company’s processes are or how motivated its team members show up to work every day, every effort goes in vain when a product doesn’t fit the market’s needs. History is a witness to such brands who undermined the value of PMF and tasted failure before vanishing forever while some made the right changes to create a product that customers would actually use and made it big.

Measure Product Feedback & User Insights 💻

With Product Feedback Surveys, understand what users need and learn ways to delight your customers.

In this article, we'll discuss how you can effectively conduct PMF surveys and what product feedback tool is best to get started. Read on.

Table of Content

- Product Market Fit Survey And That One Question That Made All The Difference

- Other Important Product Market Fit Survey Questions to Ask and Why

- Is there an Optimum Product Market Fit Survey Sample Size?

- When to Send Product Market Fit Surveys?

- How to Analyze the Product Market Fit Survey Results?

- Things to Keep in Mind Before and After the PMF Surveys

- Mistakes to Avoid After a PMF Survey

- Understanding How to Scale Your Product

- Conclusion

Product Market Fit Survey And That One Question That Made All The Difference

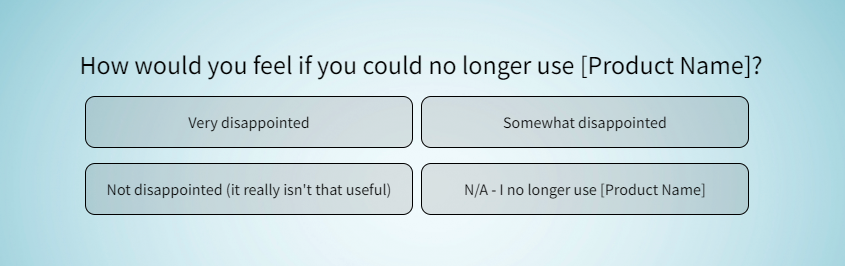

Sean Ellis Product Market survey is a tool that enables businesses to run a test to understand product market fit. It helps the companies get answers to a very important question - “How would you feel if you could no longer use the product?” and measure the percentage of respondents who will feel “very disappointed.”

The agenda behind measuring Product Market Fit is to create a solution for your customers problem at the right value and convenience and most importantly evaluate if that product is worth launching in the market.

Important Product Market Fit Survey Question

Now coming back to the question - “How would you feel if you could no longer use this product?”

A simple question, yet a powerful one that perfectly captures the emotions and needs of the customer in regard to your product and the potential problem it could solve. According to Sean Ellis, 40% is the magic percentage for product market fit.

A simple question, yet a powerful one that perfectly captures the emotions and needs of the customer in regard to your product and the potential problem it could solve. According to Sean Ellis, 40% is the magic percentage for product market fit.

He found out that companies struggling to grow almost always had <40% of users responding with “very disappointed” in their surveys. And companies that did manage to achieve growth almost always transcended those numbers.

Other Important Product Market Fit Survey Questions to Ask and Why?

Other Important Product Market Fit Survey Questions to Ask and Why?

The PMF survey also includes some other hard-hitting questions that can give you the much-needed insights you need to make your product ‘fit for the market.’

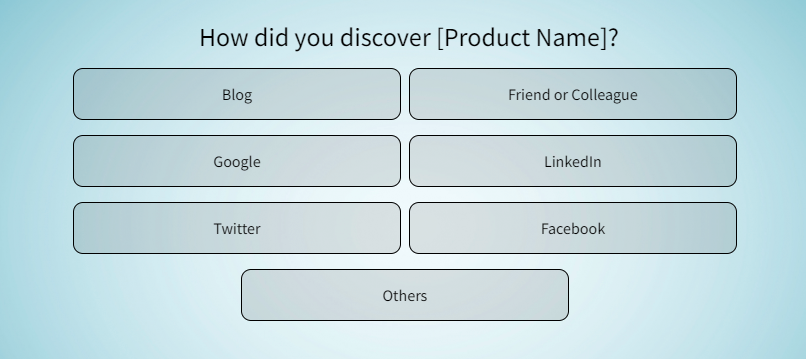

1. How did you discover/come across this product?

What seems like another simple question can be really helpful for doing market research. It can help you uncover the customer acquisition source so that you can tap into that channel to acquire or target new customers. For instance, if customers respond by answering "Facebook", you can use the channel to run ads and focus your lead capture activities toward that particular channel to target a potential market.

What seems like another simple question can be really helpful for doing market research. It can help you uncover the customer acquisition source so that you can tap into that channel to acquire or target new customers. For instance, if customers respond by answering "Facebook", you can use the channel to run ads and focus your lead capture activities toward that particular channel to target a potential market.

While almost all SaaS companies can make use of similar customer acquisition channels, the most effective ones depend highly on the buyer personas. The survey easily gives you access to those channels along with the idea about the buyer personas.

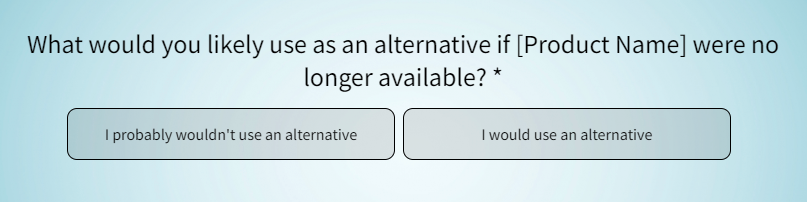

2. What would you likely use as an alternative if this product were no longer available?

Your product-driven customer-centric approach is as successful as your happy customers. No matter where you go with your product, what you do with it, and how useful you make it, there’s always an alternative available. And your customers know it!

Thinking about doing competitor analysis using platforms like Semrush or Ahrefs, G2, and whatnot? Why not just ask the customers? This question works as a perfect alternative to competitor analysis.

If the customers respond by saying- “They would choose an alternative,” you can present them with an open-ended question asking them directly about the alternative they already have in mind.

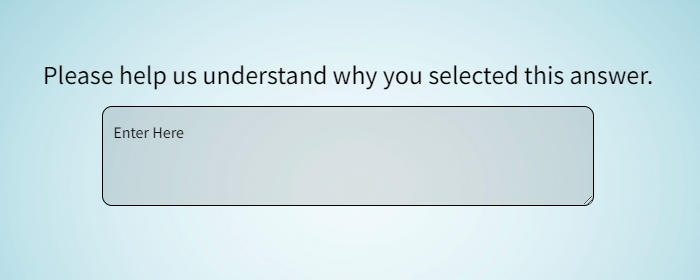

3. Open-Ended Question After the Main PMF Question

We mentioned the significance of open-ended questions in the previous point where we saw how the PMF survey is a potential alternative to competitor analysis. Open-ended questions can be rather rewarding for businesses looking for answers they might not get from anywhere else but the customers. If in doubt, you can always refer to our competitor survey template to get much-needed insights from your customers.

We mentioned the significance of open-ended questions in the previous point where we saw how the PMF survey is a potential alternative to competitor analysis. Open-ended questions can be rather rewarding for businesses looking for answers they might not get from anywhere else but the customers. If in doubt, you can always refer to our competitor survey template to get much-needed insights from your customers.

PMF surveys not only give customers options to choose from as an answer to a closed-ended question but also engage them with open-ended questions to know why they made that choice. Some of the examples would be:

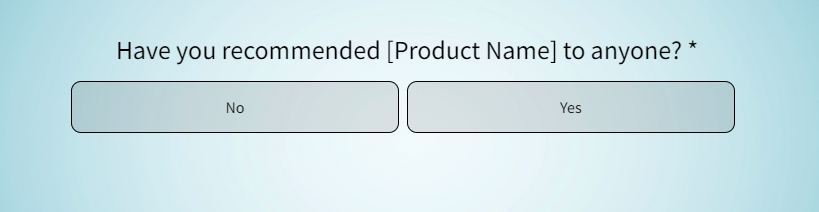

- Have you recommended this product to anyone?

This open-ended question opens new doorways to your market research and offers a better way to segment your target market into Promoters, Passives, and Detractors. The aim is to ensure excellent product attribution tracking to be able to create a list of new interested customers. Here’s how the segmentation will help you:

This open-ended question opens new doorways to your market research and offers a better way to segment your target market into Promoters, Passives, and Detractors. The aim is to ensure excellent product attribution tracking to be able to create a list of new interested customers. Here’s how the segmentation will help you:

- If a respondent chooses to answer ‘Yes’-

- You can easily identify their perception of your product with the open-ended question that follows and even explore more use cases than your initial product expectations.

- You can also put those respondents on the early promoter list and take advantage by getting their positive testimonials to be showcased during the product/feature launch. Once the launch happens, you can reach out to the promoters and request them to write reviews about your product on online review platforms. - If a respondent chooses to answer ‘No’-

- You can create a negative feedback loop to uncover the reason for their not promoting your product.

- Put those contacts in a list of ‘Passives’ and try to convert them into promoters by closing the feedback loop.

If you want to perform elaborate segmentation and dig a bit deeper into your product’s feedback, you can replace this question with a full-fledged NPS question followed by an open-ended question to get the desired response. You can always use our market research product survey questionnaire for reference.

- What type of person do you think would benefit most from the product?

One of the important aspects of any marketing strategy is creating a buyer persona for the target audience. This question allows your respondents to do that for you. With such product feedback questions, the respondents themselves will tell you what kind of individual or organization would be interested in the product.

One of the important aspects of any marketing strategy is creating a buyer persona for the target audience. This question allows your respondents to do that for you. With such product feedback questions, the respondents themselves will tell you what kind of individual or organization would be interested in the product.

You can shape your product roadmap and marketing strategies along those lines.

Another benefit of asking this question is that you’d be able to do concept testing. Being part of early-stage market research, concept testing surveys provide crucial insights into your product’s market fit and tell you whether your product is really solving any problem of prospective customers.

- How can we improve the product to better meet your needs?

A simple question that may open doors to ideas that can possibly improve your product so it can match the customers’ expectations. At the end of the day, it’s the end customer who will be using your products. So it makes more sense to take their suggestions about possible product improvements.

4. Would it be okay if we followed up by email to request a clarification of one or more of your responses?

This last question is where you will collect the respondents’ information to inform them about future product developments, replying to their feedback, sending them promotional messages, or any other major updates. This is the part where you’ll be collecting customers’ information for closing customer feedback loop.

This last question is where you will collect the respondents’ information to inform them about future product developments, replying to their feedback, sending them promotional messages, or any other major updates. This is the part where you’ll be collecting customers’ information for closing customer feedback loop.

In case of negative feedback, you can create a loop by adding the customers and your team members into the equation and work on making improvements to the product thus improving customer satisfaction.

Whereas a positive feedback loop can be leveraged by sending appreciation messages to the respondents and as we mentioned before, asking them to give your product reviews on online review platforms.

With Zonka Feedback, you can easily conduct Sean Ellis Product with a pre-built survey template that will help you cover all the metrics that we discussed above. Check out the Sean Ellis Product Market Fit survey template here:

Is there an Optimum Product Market Fit Survey Sample Size?

Now that you know the significance of the Product Market Fit survey and its questions, you must be thinking - “What should be the right sample size to conduct a PMF survey?”

If we follow the advice of Hiten Shah, the sample size need not be more than 40-50 responses. The key is to have a diverse set of respondents and to know who they are. You’d of course want to avoid wasting your time surveying customers who are not interested in your product at all.

To prevent skewed results, make sure that your feedback comes from users who are engaged in your product or company, have a bit of idea about your core features, and most importantly, have used your product within the last two weeks of conducting the survey for fresh insight.

Since Sean Ellis Product Market Fit Survey is also known as the ‘40% Test’, you should allow for a 40% response rate after sending the survey to the selected customer group.

When to Send Product Market Fit Surveys?

.jpg?width=802&height=602&name=brett-jordan-_Xwnk1DgTb8-unsplash%20(1).jpg) You know who to send surveys to, you might already have a few of those respondents in your mind, but the real question is when to send them the surveys. Should you send them when you’re building the product? Should you send them after a sales pitch? Or should you send them when they’re sleeping so they wake up to your survey and fill it up first thing in the morning? Well, there are certain stages when marketing research templates and sending those PMF surveys could be proven beneficial:

You know who to send surveys to, you might already have a few of those respondents in your mind, but the real question is when to send them the surveys. Should you send them when you’re building the product? Should you send them after a sales pitch? Or should you send them when they’re sleeping so they wake up to your survey and fill it up first thing in the morning? Well, there are certain stages when marketing research templates and sending those PMF surveys could be proven beneficial:

- You are witnessing slow growth in your business

- You want to scale your business and get crucial insights into interested customers before acquiring funding

- There has been a significant change in your product or maybe you have introduced a new feature

- You want to get the max output with Ad-hoc surveys during the A/B testing stage or for a moment marketing change

How to Analyze the Product Market Fit Survey Result?

You got the answers you were looking for, now what to do? Well, analyzing PMF results isn’t tricky at all. Just stick to the criteria mentioned below:

You got the answers you were looking for, now what to do? Well, analyzing PMF results isn’t tricky at all. Just stick to the criteria mentioned below:

- If you are above 40%

This signifies that you have already surpassed the biggest hurdle and you are sitting on a product that your target market actually wants. Just work on understanding what improvements you can make to their experience and mold your business around it.

- If you are below 40%

Not reached the 40% benchmark? Don’t worry, just focus on the actionable insights from customer feedback to improve your product. The fastest way to turn around your product’s demand is by repositioning your product around unique attributes that will contribute to solving the actual problems of your target market, thus creating a need for it.

Things to Keep in Mind Before and After the PMF Surveys

-1.jpg?width=802&height=601&name=belinda-fewings-2xRjWUA5D24-unsplash%20(1)-1.jpg) Now that you have come this far, it means that now you know the value of PMF surveys. Before you jump into it, here are a few things that you can keep in mind before and after you are done with PMF surveys.

Now that you have come this far, it means that now you know the value of PMF surveys. Before you jump into it, here are a few things that you can keep in mind before and after you are done with PMF surveys.

Before PMF Survey

While planning to conduct PMF surveys, the first thing you need to figure out is what is it that you want to test.

Time Your Scaling

It is important to decide the right time to scale the idea as it can be the make or break factor for your product in the market.

Always Follow up

Make sure that you follow up with the qualitative questions or else it’d be difficult to understand the reason behind the score.

After Product Market Fit Survey

Once you move forward to this stage, make a record of the insights you gained and what actions followed them. But that doesn’t mean that your work ends here because all of it was just a part of creating a bang-on product that can probably improve the life/working of your customers.

Even after conducting the PMF surveys, there are certain challenges that businesses face. But there’s always a way to avoid them.

Mistakes to Avoid After a PMF Survey

We have made a list of mistakes that you can avoid after successfully completing PMF surveys.

1. Underwhelming Response Leads to Disappointments

.jpg?width=802&height=602&name=brett-jordan-SZ-ZrBKtLRw-unsplash%20(1).jpg) If you are in this stage, try to optimize your product and see if it ‘fits’ and if there’s no solution to it, just drop the idea and learn to let it go.

If you are in this stage, try to optimize your product and see if it ‘fits’ and if there’s no solution to it, just drop the idea and learn to let it go.

2. Overwhelming Responses May Invite Unfavorable Outcomes

.jpg?width=802&height=535&name=jp-valery-mQTTDA_kY_8-unsplash%20(1).jpg) The majority of the time, overwhelming responses to PMF surveys lead to companies making unintelligent mistakes like increased sales hiring and enormous marketing expenditure. All this is soon followed by layoffs and budget cuts.

The majority of the time, overwhelming responses to PMF surveys lead to companies making unintelligent mistakes like increased sales hiring and enormous marketing expenditure. All this is soon followed by layoffs and budget cuts.

3. Numbers May Direct Towards Scalability But No Proper Go-to-Market Strategy

If there’s no proper go-to-market strategy, all the collected data will lead you nowhere. For a proper GTM strategy, you first need to measure the Value Fit, which basically means measuring whether your product holds any value for your target audiences. To check that, you can run NPS and CSAT surveys. You also need to measure the Purchaser Fit to measure the intention of the purchaser towards your product and see if it’s the right fit. The best way to do that is by running CES and CSAT surveys. And lastly, by measuring the Distributor Fit, you can measure whether your product attributes are shaped to fit the specific distribution channels you want to opt for.

If there’s no proper go-to-market strategy, all the collected data will lead you nowhere. For a proper GTM strategy, you first need to measure the Value Fit, which basically means measuring whether your product holds any value for your target audiences. To check that, you can run NPS and CSAT surveys. You also need to measure the Purchaser Fit to measure the intention of the purchaser towards your product and see if it’s the right fit. The best way to do that is by running CES and CSAT surveys. And lastly, by measuring the Distributor Fit, you can measure whether your product attributes are shaped to fit the specific distribution channels you want to opt for.

Now that you know the value of PMF surveys and how to properly utilize them for creating a GTM, let's talk about the last and most important part - how to do proper scaling.

Understanding How to Scale Your Product

When it comes to scaling there are two types of models:

1. Low-Touch Model

Low-touch models are the ones that usually feature self-onboarding. Their production volume is high while their ticket size/cost is low. This model relies on digital engagement to promote product use and train customers. Companies like Slack, Atlassian, and Basecamp are a few examples of successful GTM strategies using the low-touch model. One can always look at the success story of VMware to get a better understanding of the significance of a low-touch model.

How VMware made its first billion by adopting a low-touch model

Businesses can learn a great deal from the evolution of the Go-To-Marketing strategy of VMware.

VMware was one of those brands that had a supposedly “transformative” product that skipped the Product Market Fit stage and started targeting its prospective customers. In early 2002, the company had been selling two server products - GSX Server and ESX Server.

While the GSX server was a solid success in terms of sales in the first year, the ESX server was not so much. The product went into the market as a High-Touch model and only earned the company disappointment and 70 customers. They soon changed their GTM to a low-touch model by changing the distribution strategy. They started smaller deals by HP and IBM channel partners as add-on in-progress server deals. This change actually paid off as VMware gained sales momentum and made its first $1 B sales as compared to $350,000 in the first year.

2. High-Touch Model

High touch models, also known as enterprise models, are those that create a low volume for a high ticket size. High-touch models are great for handling large accounts as many SaaS companies make 80% of their revenue through large and medium-sized companies.

Let’s understand how high-touch models have been effective for companies like Zendesk which started with a low-touch model but switched to the Enterprise model and witnessed growth.

How Delphix switched to a high-touch model and increased direct sales

Delphix is a great success story of a High-Touch model.

As opposed to VMware which moved smaller deals through cheaper channels, Delphix entered the market with a low price and high volume strategy through self-service and channels. They provide a platform for data virtualization allowing their customers to take copies and transform any set of data for compliance, QA, development, and other purposes with ease. But they found that the minimum cost of adoption was high.

Their new database configurations required tweaks that escalated the overall value of the product. The company soon switched to a High-Touch model making direct sales and targeting substantial base deployments along with higher implementation support. This proved to be the right distribution fit and lead to rapid sales.

Conclusion

After Product Market Fit research, you can essentially make it easy for yourself by getting actionable data. On the basis of this data, you can make your product-driven company more customer-centric.

All this collected data works as an indicator of how well your product fits into the existing marketplace. If the result is positive, it means there’s a market out there for your product. If your product doesn’t achieve the desired Product Market Fit, you can make changes to your current approach and take the time to do more research.

Don’t forget to check out Zonka Feedback - Customer Satisfaction and Feedback Management Tool which essentially makes it easy for businesses to run Product Market Fit surveys.