In the competitive realm of the insurance industry, understanding the nuanced needs of policyholders is paramount. Catering to the diverse financial security requirements and risk appetites of potential customers shapes the core of insurance selling.

But how does an industry built on risk mitigation and service provision stay attuned to evolving customer needs?

Enter insurance surveys, an easy way to unravel the intricacies of client experiences and expectations. Whether you want to offer personalized services or pinpoint areas for improvement, these surveys are the tools to fine-tune policies, heighten customer satisfaction, and deliver services that match the pulse of customer demands.

In this article, we will delve into the impactful world of insurance surveys, exploring their benefits, survey questions, and some best practices that you can leverage to enhance your insurance services and align them precisely with customer needs. Let's get started!

TL;DR

-

Insurance surveys collect valuable feedback to enhance customer satisfaction, refine services, and align offerings with client needs. These surveys drive sales, enhance customer experience, and refine operational efficiency by addressing concerns and improving service quality.

-

Insurance survey questions can be tailored based on your survey goal whether aiming to measure customer experience, assess satisfaction with insurance claims, evaluate risk factors for mitigation, or gather specific data for business insurance offerings.

-

Some of the most popular insurance survey types include transactional insurance survey, insurance claim satisfaction survey, insurance agent evaluation survey, insurance policy survey, health insurance survey, and car insurance surveys among others.

-

By clearly defining your survey objective, utilizing skip logic and branching, and optimizing the survey for different devices, you can easily create an insurance questionnaire that can get the most relevant responses.

-

Zonka Feedback is a powerful customer experience survey tool that helps you create insurance surveys and share them with multiple survey distribution channels. You can analyze survey results to identify trends and take action to close the feedback loop. Schedule a demo now!

Elevate CX with Customer Feedback🔥

Collect real-time, in-moment feedback at all touchpoints through insurance surveys and leverage feedback insights to transform customer experience.

Why Should You Consider Insurance Surveys?

Insurance surveys are a great way to gather feedback, opinions, and insights from policyholders, clients or customers about their insurance experiences. They aim to assess customer satisfaction, identify areas for improvement, understand customer needs, and enhance the overall quality of insurance services provided.

Through insurance surveys, companies can gather feedback on policy offerings, customer service, claims processes, and overall experiences. By considering insurance surveys, you can:

-

Increase Insurance Sales: Insurance surveys are a great way to understand client preferences and adapt your offerings to match their needs, which can potentially lead to increased sales.

-

Enhance Data Collection: These surveys are invaluable for gathering comprehensive data, enabling insurance companies to make informed decisions based on customer feedback, trends, and preferences.

-

Improve Offerings: Insights garnered from surveys assist in refining insurance products and services, aligning them more accurately with customer needs and expectations.

-

Better Risk Assessments: Through surveys, insurers can better assess and mitigate risks, providing more accurate coverage and setting premiums that align with the potential risks involved.

-

Boost Customer Experience: Feedback from surveys helps in identifying pain points, streamlining processes, and improving service quality, thereby elevating overall customer experience and satisfaction levels.

If you are looking to get started with creating an insurance survey, here's an insurance claim satisfaction survey template that you can get started with to collect customer feedback within minutes.

General & Health Insurance Survey Questionnaire

A survey questionnaire for general and health insurance aims to gather feedback on various aspects of insurance services, policies, and customer experiences. It's designed to understand the specific needs, preferences, and concerns of individuals related to both general insurance (e.g., home, auto) and health insurance, helping insurance providers tailor their offerings and services to better meet customer expectations.

Here are some insurance survey questions that you can add to your survey to get customer insights.

-

Are you looking for personal insurance or business needs?

-

What type of insurance coverage are you currently seeking or considering? (e.g., health, auto, home, life)

-

What factors are most important to you when choosing an insurance provider? (e.g., cost, coverage options, customer service)

-

Are you already insured with other providers?

-

Where are you insured currently?

-

Do you prefer online interactions or face-to-face consultations when discussing insurance options?

Insurance surveys cover a wide array of aspects within the insurance industry. They can focus on different areas such as claims processing, policy offerings, customer service experiences, ease of application or renewal processes, understanding client needs, and evaluating overall insurance experiences.

Let us look at the different types of health insurance survey questions that you can add to your survey based on the purpose.

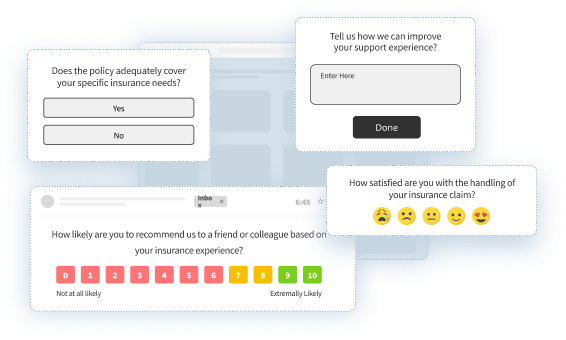

1. Insurance Survey Questions for Transactional Survey

Transaction survey in insurance is conducted after a specific interaction or transaction between the insurer and the policyholder or customer. These surveys aim to capture feedback and assess the satisfaction level of customers immediately after a particular insurance-related activity, such as purchasing a policy, filing a claim, or interacting with an agent.

Insights from transactional surveys help insurance companies understand immediate concerns and perform sentiment analysis to improve customer satisfaction and overall insurance service quality.

-

How easy was it to initiate your recent claim process?

-

Did you face any difficulties while submitting your health insurance claim?

-

How satisfied are you with the time taken to process your claim?

-

Were you updated regularly on the status of your claim?

-

How clear were the communications provided during the claim processing?

-

Did you find the information about your claim status accurate and helpful?

-

Did our customer service representative adequately address your questions during the policy purchase?

-

How would you rate the speed of response from our team after you filed your insurance claim?

-

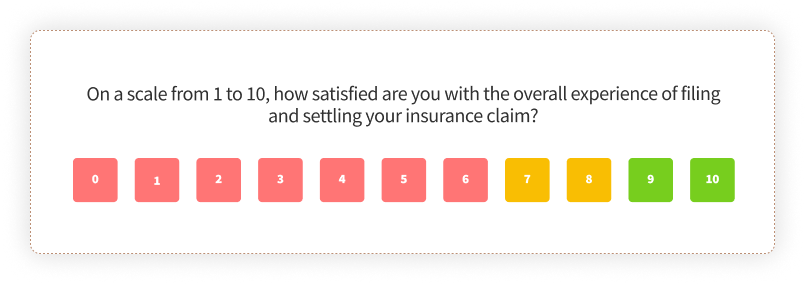

On a scale from 1 to 10, how would you rate your recent claim experience?

2. Insurance Customer Experience Survey Questions

Insurance customer experience encompasses every touchpoint, from policy purchase to claim settlement and directly influences customer satisfaction, loyalty and brand advocacy. A positive experience not only retains customers but also promotes trust and encourages referrals.

Understanding customer perceptions through insurance customer experience survey questions helps in refining services and streamlining processes for enhancing the overall insurance service delivery.

-

How would you rate your experience while purchasing our insurance policy?

-

Were the policy details explained clearly during the purchase process?

-

Did you find the policy documentation easy to understand?

-

Did the representatives address your queries and concerns effectively?

-

How convenient was the process of renewing your insurance policy?

-

Were you regularly informed about any policy changes or updates?

-

On a scale from 1 to 10, how satisfied are you with your overall experience with our insurance services?

3. Insurance Claim Satisfaction Survey

When you add insurance claim satisfaction survey questions, you get insights into the effectiveness of the claim settlement process. Assessing satisfaction levels post-claim helps in understanding customer sentiments and gauging the efficiency of the insurance company in resolving issues.

These insights generally help in improving claim handling procedures, addressing customer grievances, and ultimately enhancing overall satisfaction with the insurance provider.

-

How easy was it to initiate the claim process?

-

Did you encounter any difficulties while filing your insurance claim?

-

Were you satisfied with the speed of claim processing?

-

Were you kept informed about the status of your claim throughout the process?

-

Did we provide clear and timely updates regarding your claim?

-

Were you satisfied with the amount provided as a claim settlement?

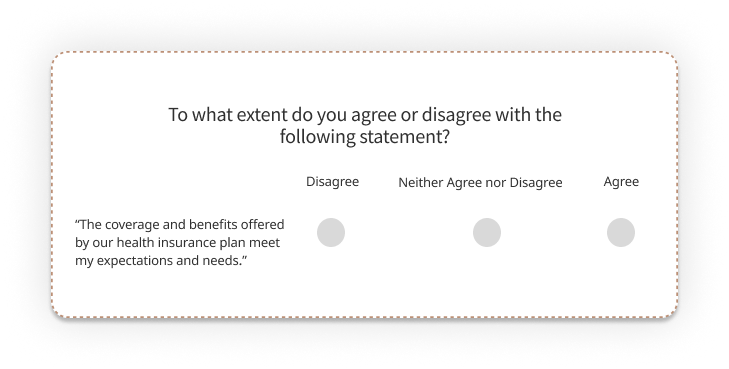

4. Insurance Questionnaire for Insurance Policy Survey

Including insurance policy survey questions will help you assess various facets of policy comprehension, adequacy, and renewal experiences. Assessing suitability ensures policies align with individual needs while evaluating renewal processes and customer support indicates overall service quality.

When you gather feedback on policy satisfaction, you can refine your policies, enhance customer experiences, and gauge potential advocacy, influencing both customer retention and referrals.

-

Who influenced you to get an insurance policy?

-

What kind of insurance policies do you have?

-

Have you reviewed the policy terms and conditions thoroughly?

-

Were the policy features and limitations explained clearly at the time of purchase?

-

Does the policy adequately cover your specific insurance needs?

-

How regularly do you pay your premiums?

5. Insurance Agent Evaluation Survey

If you want to conduct frontline feedback, you must start with assessing frontline representatives' performance as it impacts customer satisfaction directly. Feedback on agents' communication, knowledge, and assistance can help you to understand service quality ensuring customers receive informed, supportive, and satisfying interactions, thereby enhancing overall trust in your company.

-

How knowledgeable was your insurance agent about various insurance products?

-

Did the agent provide sufficient information about policy features and options?

-

How effective was the agent's communication regarding policy details and terms?

-

How satisfied are you with the promptness of the agent's responses to your inquiries?

-

Did the agent assist you efficiently during the claims process?

-

Overall, how would you rate your experience with this insurance agent?

6. Insurance Survey Questions for Claim Resolution Satisfaction Survey

To understand customers' perception of the claim handling process, you must incorporate claim resolution satisfaction questions in your survey for insurance. It assesses the efficiency, fairness, and communication of the insurer during claim settlements, offering insights into the customer's overall satisfaction.

-

How satisfied were you with the overall ease of filing a claim with us?

-

Did the claim resolution process meet your initial expectations when you filed the claim?

-

How well did we communicate with you throughout the claim resolution process?

-

Were you satisfied with the final settlement amount received for your claim?

-

Were there any challenges or hurdles you faced during the claim settlement process?

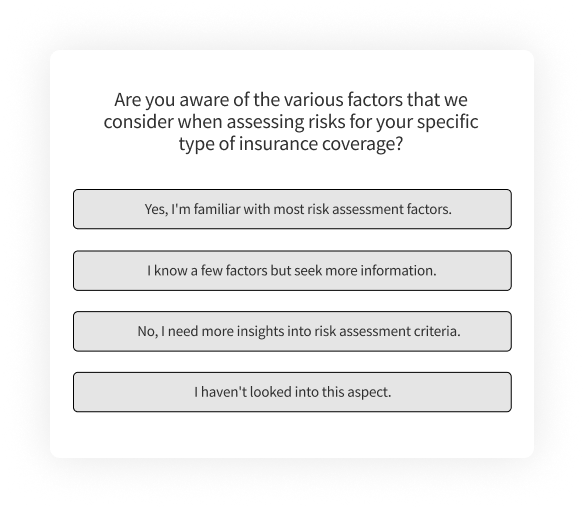

7. Insurance Survey Questions for Risk Assessment Surveys

A risk assessment survey is integral in insurance surveys as it systematically evaluates potential risks associated with insured entities, for example, property, health, or business operations. This evaluation is crucial as it enables insurers to accurately assess risk levels, determine appropriate coverage, and set premiums that align with the potential risks involved.

-

Do you have a clear understanding of the risks associated with your property/business/health that require insurance coverage?

-

Have you experienced any incidents or damages in the past year that could impact your insurance coverage or premiums?

-

Are there any potential risks or changes in circumstances that you foresee affecting your insurance needs in the near future?

-

Would you be interested in additional risk assessment services or consultations to enhance your insurance coverage?

8. Insurance Feedback Questions for Business Insurance

Business insurance encompasses various policies tailored to protect businesses from diverse risks like property damage, liability claims, and operational interruptions. It plays a pivotal role in shielding enterprises from potential financial losses due to unforeseen events such as natural disasters, accidents like car accident or truck accident, or legal issues. This coverage is crucial as it safeguards businesses, ensuring their sustainability and resilience in the face of unpredictable challenges, ultimately securing their financial stability and operational continuity.

-

Do you currently have business insurance coverage?

-

Have you experienced any difficulties when filing a claim with us?

-

Were you adequately informed about the coverage limitations and exclusions in your policy?

-

How responsive do you think we are in handling inquiries or concerns related to your policy?

-

Do you believe your business insurance policy offers comprehensive protection against potential risks?

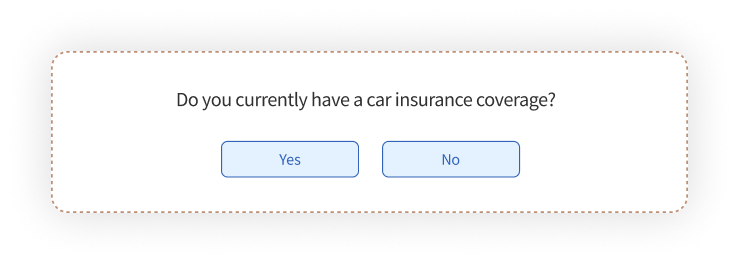

9. Insurance Survey Questions for Car Insurance

Surveying car insurance experiences helps in assessing policy satisfaction, claim resolution, customer service, and overall policy suitability. By gathering feedback through targeted car insurance survey questions, insurers gain valuable insights to enhance coverage, improve service quality, and ensure policy alignment with drivers' needs. Additionally, incorporating feedback specific to car hauler insurance can further refine offerings to meet the unique requirements and challenges faced by drivers in this niche market.

-

How satisfied are you with the coverage provided by our insurance policy?

-

How well does the insurance policy cover repair costs or damages?

-

Were you informed about any specific conditions or limitations within our insurance policy?

-

How well does the insurance policy protect against theft or vandalism of your vehicle?

-

Were you offered roadside assistance or additional perks as part of your insurance?

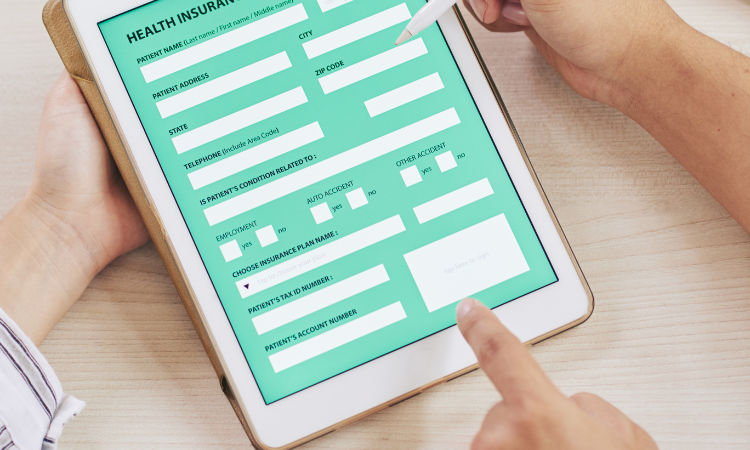

10. Health Insurance Survey

These survey questions help health insurance companies gather feedback and insights from policyholders regarding their health insurance experiences. These surveys cover various aspects, including policy understanding of health care services, satisfaction with claim resolutions, customer service interactions, and overall policy suitability.

By seeking input through health insurance coverage questions, you can get a big picture of satisfaction levels of customers and tailor policies better to meet the diverse healthcare needs.

-

Do you currently have health insurance plans?

-

Do you think your health insurance rates are reasonable?

-

How satisfied are you with the coverage and benefits offered by our health insurance plan?

-

Did you find the process of filing a health insurance claim straightforward and convenient?

-

Were the explanations regarding policy terms and coverage clear and easy to understand?

-

Have you faced any challenges or issues with the health insurance policy that you would like to highlight?

Best Practices for Creating a Survey for Insurance

Crafting an effective insurance survey requires strategic consideration to generate relevant and maximum responses. Several best practices can significantly enhance the quality and usefulness of your survey. Let's explore some essential techniques to optimize your insurance questionnaire.

-

Clearly Define Objectives: Determine the purpose of the insurance questionnaire—whether it's assessing customer satisfaction, understanding policy needs, or evaluating claims processing—and then tailor questions accordingly.

-

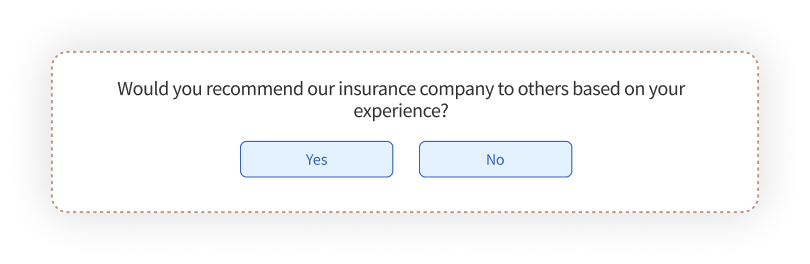

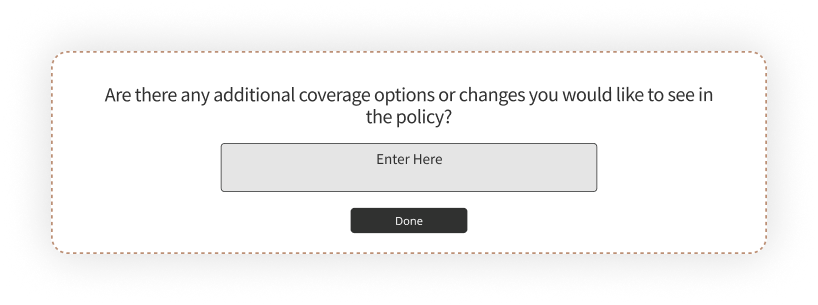

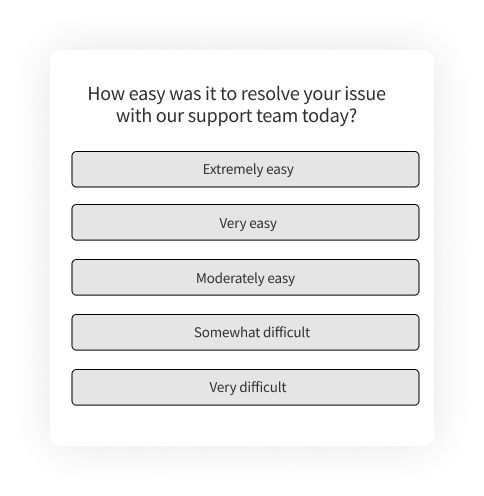

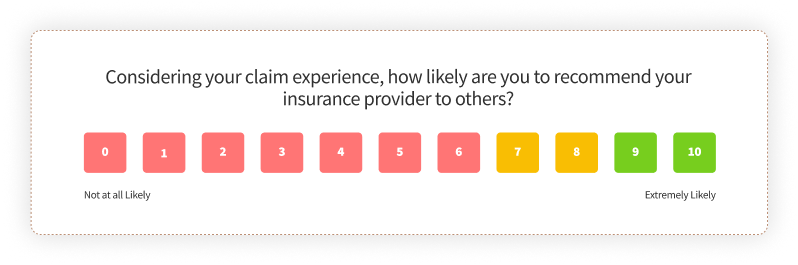

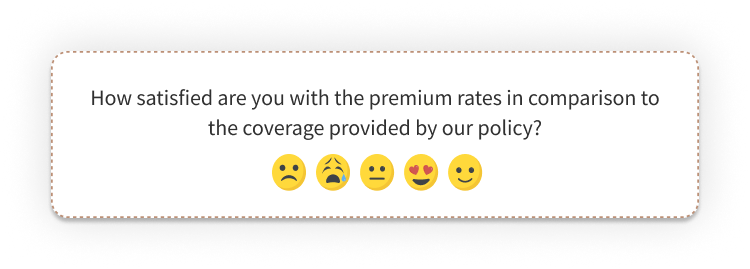

Utilize a Mix of Question Types: Incorporate a variety of question formats, including multiple-choice, rating scale questions, open-ended questions, and different types of questions like Likert scale, thumbs up down survey, yes no surveys, etc. for a comprehensive understanding of respondents' perspectives.

-

Prioritize Relevance: Ensure that your questions are relevant to the insurance survey's purpose and avoid unnecessary queries to keep the survey concise and focused. By using skip logic and branching, you can gather meaningful responses and better insights into customer needs and experiences.

-

Test Before Launch: Pilot the questionnaire with a small group to identify any ambiguities, glitches, or issues before wider distribution. This practice ensures that the survey functions smoothly and collects accurate data, optimizing its effectiveness.

-

Consider Customer Experience: Keep the survey user-friendly and accessible across different devices, allowing respondents to complete it easily and conveniently. A seamless survey experience enhances customer participation and delivers more comprehensive feedback.

Conclusion

Conducting insurance surveys is essential in understanding customer needs, refining services, and improving overall experiences. By implementing comprehensive insurance survey questionnaires, you can streamline operations and tailor insurance offerings to match specific client requirements.

You can simplify the creation of insurance surveys by utilizing powerful survey software, which streamlines the entire survey-building process. Zonka Feedback is one such online survey tool that can help you create insurance surveys with ready-made survey templates, share them through multiple survey channels, and analyze results to take action and close the feedback loop.

You can schedule a demo to align your insurance services with customer needs and refine customer experience now!

.png)

.jpg)

.jpg)